While we hope that donors will follow the example of Helmut Stern in making broad, unrestricted legacy gifts for maximum community impact, people also make planned gifts to create or support specific funds, including nonprofit endowments, scholarships, administrative and field-of-interest funds. Any and all of these can be named for you or a loved one.

Supporting nonprofits is one of the most popular ways people want to leave a legacy through their estate plans. Many people modestly dismiss their loyal support of a nonprofit—"oh, I only give a couple hundred dollars annually”. That loyal support is significant and that consistency makes such a difference, though! In fact, what happens when you’re gone? That’s where an endowment fund through your estate can continue to provide that support beyond your lifetime. Think of it as annuitizing your annual giving.

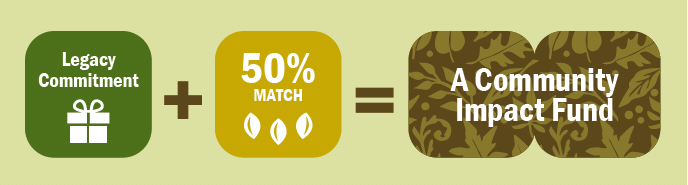

Through the generosity of Helmut Stern, documented planned gifts—gifts that are made through a will or estate—to benefit permanent funds at the Foundation will be matched at 50% of the projected gift value, up to $50K per donor, through a new Community Impact fund named for the donor or a donor’s loved one. That’s right—just for planning ahead, members of the community have the opportunity to see current funds put to use in the community! You can participate in this program with a legacy gift of just $10,000—because a current Community Impact Fund can be created at $5,000.